The tax hike on alcoholic beverages has been reversed by the National Assembly at an extraordinary session on Monday.

The Minister of Finance and Economic Affairs, Mamburay Njie, tabled the motion for the reversal of the tax hike on alcoholic beverages before the lawmakers.

Mr. Njie said the motion was brought in accordance with Section 149 of the 1997 Constitution which requires the approval of the National Assembly before “any tax could be imposed, altered or revised”.

He said that the tax hike on alcoholic beverages was part of the policy proposal on the Supplementary Appropriation Bill 2019 that was approved by parliamentarians in 2018.

Mr. Njie said the tax hike which was proposed by the Ministry of Finance was done in good faith but it came with its own challenges and was unrealistic for implementation. He added that the hike created challenges for the leisure industry.

He said his ministry together with stakeholders held several consultations on the effects and challenges on the implementation of the tax hike with a view of resolving the matter amicably in the national interest.

He pointed out that the tax hike was in no way an intended target of a specific sector but rather a social safety net for the youth from the negative effects of alcohol abuse due to the lower prices of alcoholic beverages.

He said that road safety over the years had been compromised by drink-driving mostly by the youth.

Mr. Njie revealed that Banjul Breweries, the only beer brewery in the country, had paid D132 million to the Gambia Revenue Authority due to the tax hike which was a plus to the economy but its threatened the closure of the brewery which would have brought economic losses to The Gambia.

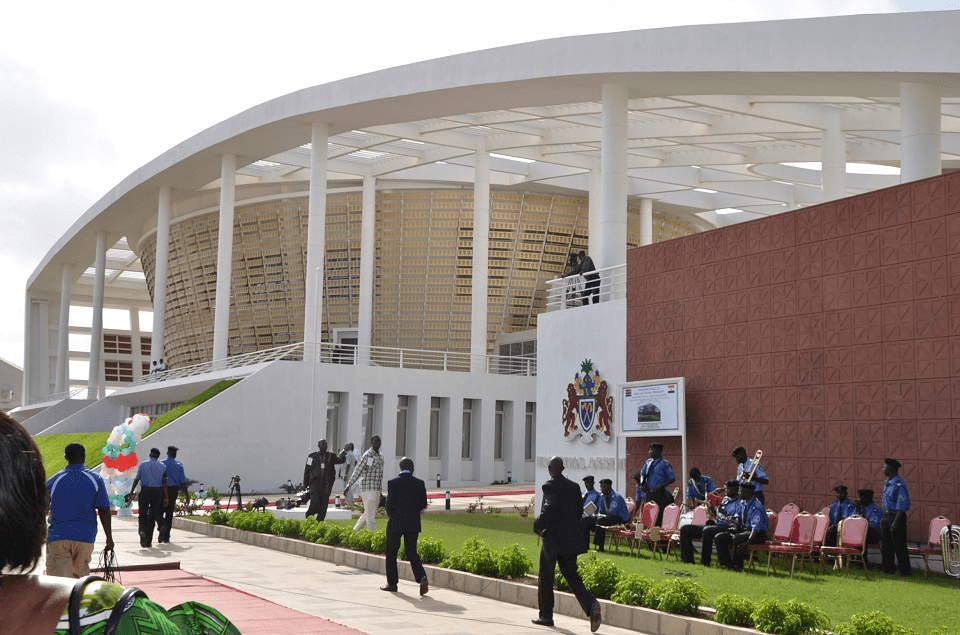

The National Assembly unanimously approved the reduction on the excise tax on alcoholic beverages.

Recent Comments